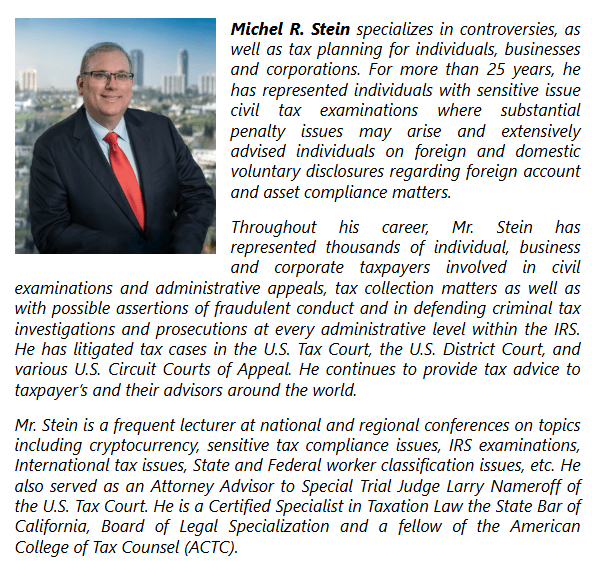

We are pleased to announce that Michel R. Stein, Evan J. Davis and Philipp Behrendt will be speaking at the upcoming CalCPA Cryptocurrency Tax Compliance webinar, Tuesday, August 12, 2025, 9:00 a.m. – 10:30 a.m. (PST).

The IRS continues to press its concern over massive under-reporting of income from cryptocurrency and other digital asset transactions. Tax advisers for clients with cryptocurrency holdings must understand the reporting requirements for transfers and the IRS scrutiny cryptocurrency investors are likely to face in the future.

Cryptocurrency is a digital asset using cryptographic techniques–rather than a central authority–to secure transfer currency units. Uniquely, no bank or government authority records the transfer of funds. And yet, the digital asset world will see its own Information Reporting (1099-DA) beginning with transactions in 2025.

The rise of Bitcoin’s value has prompted a massive compliance initiative aimed to identify taxpayers’ gain with audits going back to inceptions of the taxpayer’s trading activity. The IRS treats digital assets as property rather than currency for U.S. tax purposes. As a result, any transaction involving cryptocurrency is treated as a taxable sale or exchange of property, with taxpayers responsible for tracking their cost basis, gains, and losses.

We will discuss IRS enforcement actions focused on digital assets, providing an overview of the IRS’s guidance on various transactions, and provide practical guidance on the U.S. tax reporting obligations arising from cryptocurrency transactions.

Click Here for More Information

For more information, please contact Michel R. Stein at stein@taxlitigator.com

For more information, please contact Evan J. Davis at davis@taxlitigator.com

For more information, please contact Philipp Behrendt at behrendt@taxlitigator.com