HOCHMAN SALKIN TOSCHER PEREZ P.C. is proud to be recognized by Chambers and Partners as one of only three top tier law firms in its U.S. 2023 High Net Worth Guide in the category of Tax: Private Client, as well as a top firm nationwide in the Tax Controversy and Tax Fraud areas.

Chambers concluded that HOCHMAN SALKIN TOSCHER PEREZ P.C., is “a superb firm for tax controversy matters” and “has a hugely impressive track record in tax controversy, alongside criminal and civil litigation at both state and federal levels.” Chambers quotes clients as noting: “They’re my go-to firm for sophisticated tax controversy matters.” “The firm’s lawyers have deep, substantive knowledge and key connections throughout the California federal bench.“

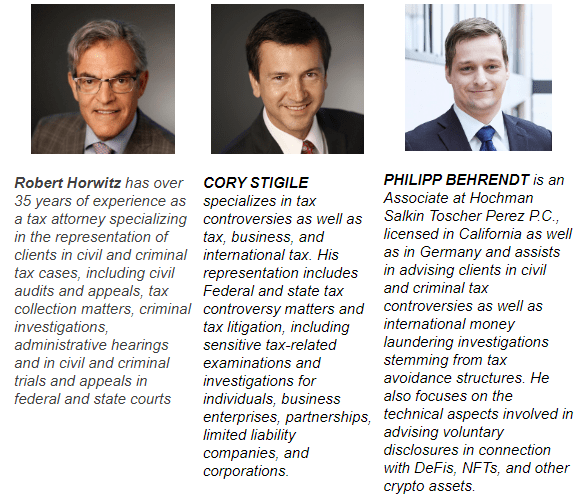

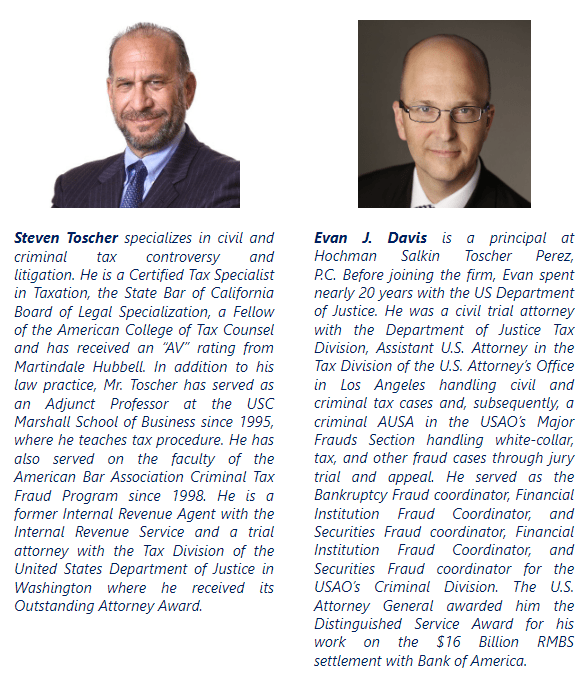

In addition to the recognition of the firm, Steven Toscher, Dennis Perez and Sandra R. Brown were named top tier lawyers in the 2023 High Net Worth Guide Tax: Private Client USA Rankings. Steven was also ranked as a top Tax Fraud litigator for a third consecutive year.

Chambers reports that Steve “is noted for his experience advising clients on contentious tax matters, including IRS and DOJ litigation. He regularly works with corporations and individuals.” “He is a well-regarded tax practitioner who advises clients on sensitive issues, including criminal tax fraud investigations.” “Steve Toscher has an excellent reputation as a litigator.“

Steve has been representing clients for almost 40 years before the United States Tax Court, the Federal District Courts, the Internal Revenue Service, the Tax Division of the U.S. Department of Justice and the Offices of the United States Attorney, numerous state taxing authorities in federal and state court litigation and appeals. He is a Certified Specialist in Taxation by the State Bar of California Board of Legal Specialization and is often ranked in California as well as nationwide as a top tax lawyer including being honored by the Taxation Section of the California State Bar with the 2017 Joanne M. Garvey Award.

Dennis Perez represents high-net-worth clients in domestic tax examinations and administrative appeals as well as in civil and criminal litigation. As noted by Chambers, “He is one of the strongest practitioners in the country on the foreign reporting space.” “He’s a great practitioner. He is definitely somebody I can recommend in this area.”

A former senior trial attorney with the IRS District Counsel in Los Angeles, California, Mr. Perez has, for more than 35 years, represented and advised clients in foreign and domestic civil tax examinations and administrative appeals where substantial civil income tax and penalty issues may arise, and he has extensive experience in representing clients in criminal tax fraud investigations and prosecutions. He is also a Certified Specialist in Taxation, the State Bar of California Board of Legal Specialization. Mr. Perez is the first-ever recipient of the Los Angeles Lawyer Sam Lipsman Service Award.

Sandra R. Brown represents high-net-worth individuals and businesses in a broad range of civil and criminal tax investigations. Chambers reports that “She is a very good attorney. She is knowledgeable, technical and knows her stuff.” “Sandra Brown is exceptional. She has a wealth of experience she is really clever and a very good strategist. I would happily refer a case to her.”

In more than 30 years as a tax litigator, Ms. Brown has a vast depth of experience in complex civil and criminal tax matters, having personally handled over 2,000 cases before the United States District Courts, the Ninth Circuit Court of Appeals, the United States Bankruptcy Court, the United States Bankruptcy Appellate Panel and the California Superior Court. Those cases included nationally significant civil tax cases such as two Supreme Court decisions and a multitude of published 9th Circuit decisions. Ms. Brown received her LL.M. in Taxation from the University of Denver, served as the Acting U.S. Attorney for the Central District of California, Chief of the Tax Division, and, in 2021, was named a Top Women Lawyer in California.

HOCHMAN SALKIN TOSCHER PEREZ P.C., enjoys an unparalleled reputation for excellence and integrity in the tax community. For more than 60 years, the firm has been serving clients throughout the United States with federal and state civil tax litigation, defense of criminal tax prosecutions, and tax disputes with the federal, state and local taxing authorities. More information about the firm and our attorneys is available at https://www.taxlitigator.com/