Those who commit tax crimes are among the least likely to re-offend, as statistics from the United States Sentencing Commission – the group that drafts the Federal Sentencing Guidelines used by judges to help determine what sentence to impose – have consistently shown. Mostly well-educated, older, and without any prior criminal history, tax offenders almost always are deeply ashamed of having committed their crime and don’t want to see the inside of a courtroom or, even worse, a federal prison, ever again.

Major Sentencing Guideline Changes for Most Tax Offenders, With More on the Way: ABA Sentencing Panel by EVAN DAVIS

Posted in Uncategorized

Happy Holidays from Hochman Salkin Toscher Perez P.C.

Steven Toscher, Managing Principal

Hochman Salkin Toscher Perez P.C.

toscher@taxlitigator.com

Founded in 1960, Hochman Salkin Toscher Perez, P.C., is internationally recognized as the preeminent tax law firm on the West Coast. The reputation of the firm for excellence and integrity in the tax community is unparalleled. The firm specializes in federal and state civil and criminal tax litigation, tax controversies and tax disputes with the federal, state, and local taxing authorities and white collar criminal defense, and has received many notable decisions on behalf of its clients before the Federal Appellate Courts, the Federal District Courts, the Bankruptcy Courts, the United States Tax Court, and various state courts, including the California Franchise Tax Board California Department of Tax and Fee Administration

and the California Employment Development Department.

Posted in Uncategorized

DENNIS PEREZ, MICHEL STEIN and ROBERT HORWITZ to Speak at Upcoming CalCPA Webinar

We are pleased to announce that Dennis Perez, Michel Stein, and Robert Horwitz will be speaking at the upcoming CalCPA webinar “Federal and State Residency Issues” Tuesday, December 12, 2023, 9:00 a.m. – 10:00 a.m. (PST).

This webinar will guide tax professionals and advisers on the latest IRS examination guidance and state tax law issues regarding taxpayer residency. The panel will discuss federal and state tax residency rules, residency and allocation matters, U.S. income tax treaties, available tax planning techniques, managing nonresident audits, and overcoming state regulatory challenges. Advising taxpayers on issues relating to residency has become even more cumbersome. The IRS LB&I unit has issued examination guidance focused on taxpayer residency and the application of U.S. income tax treaties. State tax residency rules and an increase in state audits and enforcement require tax professionals to become knowledgeable of new state residency and allocation issues to implement effective tax planning strategies for taxpayers.

Posted in Uncategorized

PLI – Internal Revenue Service Practice and Procedure Deskbook – Edward M. Robbins, Jr.

We are pleased to announce that in October of this year the 9th edition of the Practicing Law Institutes Deskbook on Internal Revenue Service Practice and Procedure was published. The Deskbook is co-authored by Principal of the firm Edward M. Robbins, Jr. It is a great resource for many issues confronting tax practitioners in everyday practice. For more information on this resource click on the link Here.

Posted in Uncategorized

USC Gould School of Law 2024 Tax Institute – January 22-24, 2024

We are pleased to announce that the USC Gould School of Law 2024 Tax Institute will take place on January 22-24 at the Sheraton Grand Hotel, Los Angeles.

We have an exceptional line up of speakers and topics this year. The three day Institute covers the most important topics in corporate taxation, partnership taxation and a full day of estate planning. Tuesday afternoon will cover important civil and criminal tax controversy topics and ethical issues important to all tax practitioners.

The Institute is by far one of the best programs in the country for both experienced tax practitioners and those looking to gain more experience in their tax practices.

We are pleased to announce that three of our Principals will be presenting this year.

Sandra R. Brown

Defending Employee Retention Credit Examinations and(Criminal) Investigations

January 23, 2024: 2-3:00 pm

Michel R. Stein

Handling High Wealth Taxpayer Examinations –What We Can Expect After the New IRS Inflation Reduction Act Funding

January 23, 2024: 4:25-5:25 pm

Jonathan Kalinski

Employment Tax Controversies, including AB5

January 23, 2024: 6-7:30 pm

Registration information and the full program can be found at the link Here.

We look forward to seeing you.

Posted in Uncategorized

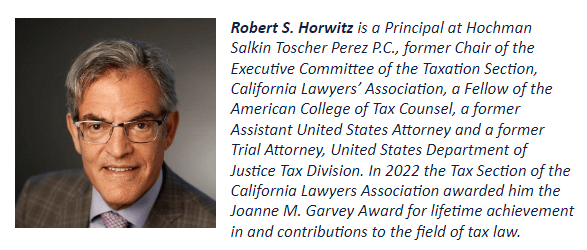

ABA 40th Annual National Institute on Criminal Tax Fraud and the 13th Annual National Institute on Tax Controversy – December 7-9, 2023

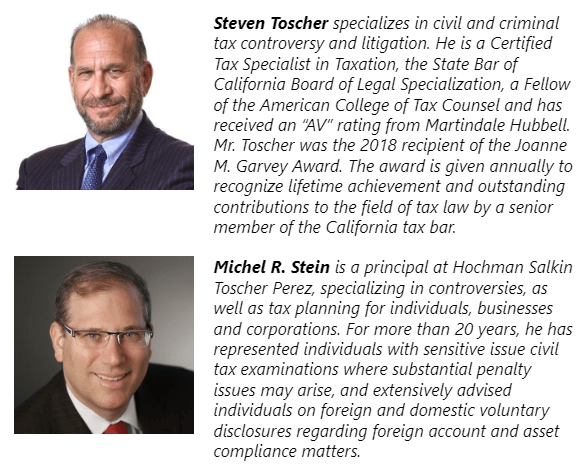

We are pleased to announce that the ABA 40th Annual National Institute on Criminal Tax Fraud and the 13th Annual National Institute on Tax Controversy will take place this year on December 7-9 in Las Vegas, Nevada. Managing Principal Steven Toscher is honored to once again co-chair the Institutes with Kathy Keneally.

We have an unbelievable line up of speakers and topics this year and we anticipate record attendance. The three day Institute covering the most important topics in civil and criminal tax controversy is by far the best program in the country for both experienced and not so experienced practitioners . And as Josh Ungerman says, “It’s Vegas Baby.”

We are pleased that four of our Principals will be presenting this year.

Evan Davis

Sentencing Guidelines: How To Best Represent Your Client In Light Of Recent Developments

Sandra Brown

A Look into the Future of IRS Enforcement – A Discussion with Leading Tax Controversy Thought Leaders

Edward M. Robbins, Jr.

Criminal Tax Workshop

Philipp Behrendt

Low-Income Taxpayers: Effective Use of Artificial Intelligence

Registration information and the full program can be found Here

We look forward to seeing you in Las Vegas

Steven Toscher

Hochman Salkin Toscher Perez P.C.

toscher@taxlitigator.com

Posted in Uncategorized

If Your Return Preparer E-Files Your Return Late, You Can Be Hit with Late Filing and Late Payment Penalties by ROBERT S. HORWITZ

Taxpayers are required to file their tax returns by the due date. They cannot delegate that duty to an accountant, attorney, or other agent. They cannot rely on an agent’s statement that an extension to file has been obtained. A taxpayer cannot avoid a late filing or late payment penalty because the accountant failed to send the return in on time. This was the teaching of United States v. Boyle, 469 U.S. 241 (1985), where the Supreme Court upheld failure to file penalties against an executor who relied on the estate’s attorneys to prepare and file an estate tax return on time.

Posted in Uncategorized

STEVEN TOSCHER, MICHEL STEIN and PHILIPP BEHRENDT to Speak at Upcoming Strafford Webinar

We are pleased to announce that Steven Toscher, Michel R. Stein, and Philipp Behrendt will be speaking at the upcoming Strafford webinar “Tax Treatment of Crypto Staking Rewards: Revenue Ruling 2023-14, Tax Filing Requirements, Managing IRS Examinations,” Tuesday, November 20, 2023, 10:00 a.m. – 11:30 a.m. (PST).

Cryptocurrency has exploded over the last few years causing significant concerns regarding the taxation of these transactions for sellers, purchasers, and investors. Tax counsel and accountants for clients holding and selling cryptocurrency and those engaging in transactions involving crypto staking rewards must understand applicable tax rules, reporting requirements for these transactions, and the tax treatment of crypto staking rewards.

Crypto staking is when a person pledges their cryptocurrency to help validate transactions on the blockchain. This allows crypto holders an opportunity to put their digital assets to work and earn passive income without selling them. However, such transactions are now subject to certain tax treatment for those engaging in these transactions.

Recently, the IRS issued Revenue Ruling 2023-14, guidance directly addressing the tax treatment of crypto staking rewards. The new guidance generally provides that rewards received in exchange for cryptocurrency staking are included in a taxpayer’s gross income in the taxable year in which the taxpayer first has the ability to dispose of the cryptocurrency received. In addition, this may require amending prior year tax returns for taxpayers who failed to report such staking rewards and those who previously reported such staked assets as income if the taxpayer did not have such dominion or control.

Tax counsel and advisers must recognize applicable tax rules for crypto staking rewards and define proper reporting and tax treatment for these transactions.

Listen as our panel discusses critical tax considerations for crypto staking rewards, Revenue Ruling 2023-14, analyzing IRS monitoring to increase compliance, and defining proper reporting and tax treatment for crypto staking rewards.

We are also pleased to announce that we will be able to offer a limited number of complimentary and reduced cost tickets for this program on a first come first serve basis. If you are interested in attending please contact Sharon Tanaka at sht@taxlitigator.com.

Posted in Uncategorized

STEVEN TOSCHER and MICHEL STEIN to Speak at Upcoming CalCPA Webinar

We are pleased to announce that Steven Toscher and Michel R. Stein, will be speaking at the upcoming CalCPA webinar “Handling the New IRS Global High Wealth Examinations 2023,” Tuesday, November 14, 2023, 9:00 a.m. – 10:00 a.m. (PST).

The Global High Wealth Group is an industry group created by the IRS LB&I in 2009. The purpose of the Global High Wealth Group (also known as the “Wealth Squad”) is to bring together an IRS team of specialists to conduct detailed examinations of complex returns of high wealth individuals and their related entities. The IRS with updated Internal Revenue Manual provisions governing high wealth audits is poised to start the examination of hundreds of high net-worth taxpayers and large partnerships. Recent IRS announcements state that additional resources provided by the Inflation Reduction Act of 2022 will be laser focused on high wealth persons and examinations, which typically involve pass-through businesses, related trusts, foreign holdings, tiered partnerships, and related tax-exempt organizations.

The program’s learning objectives include:

- Understanding the Global High Wealth Group audit program

- Learn strategies to minimize risk from Global High Wealth Group audits

- Master techniques in handling and advising clients examined by the Global High Wealth Group

We anticipate that attendees will: Better understand the “Wealth Squad” examination process, Know what foreign and domestic audits issues will be scrutinized during a “Wealth Squad” examination, Decipher “Wealth Squad” document requests and summonses, and more easily identify key strategies to minimize exposure from a “Wealth Squad” examination.

Don’t be caught unprepared!

Posted in Uncategorized

MICHEL STEIN and SANDRA BROWN to Speak at Upcoming NYU 82nd Institute on Federal Taxation

We are pleased to announce that two of our partners will be speaking at the upcoming NYU 82nd Institute on Federal Taxation being held at the Clairmont Resort and Spa, Berkeley, California on November 12-17, 2023.

We have an excellent lineup of programs –

From the Experts: Tax Controversy and Tax Litigation – Civil & Criminal Tax Update

Featuring Sandra Brown

Sunday, November 12th at 1:15 p.m. to 3:45 p.m.

How Far Can You Go? Ethical and Penalty Issues in Everyday Practice

Featuring Michel R. Stein

Thursday, November 16th at 5:15 p.m. to 6:55 p.m.

This year’s program provides unparalleled educational and professional development opportunities delivered by a diverse and distinguished faculty of recognized tax and wealth-transfer authorities with a positive approach to current and practical subjects.

While the Institute is designed primarily to serve as a forum where tax and wealth transfer oriented people may freely exchange ideas on practical problems, professional status is not a prerequisite for registration. This program is designed for attorneys, accountants, financial planners, planned giving professionals, bank and trust administrators, insurance agents, elder law specialists, non-profit administrators, wealth management professionals, enrolled agents, educators, and others who would benefit from high quality continuing education. The highest level of learning has been the hallmark of prior Institutes and we shall endeavor to again maintain this standard.

Posted in Uncategorized