We are pleased to announce that Michel R. Stein and Philipp Behrendt will be speaking at the upcoming CalCPA webinar on Cryptocurrency Tax Compliance: Tax Filing Requirements, New Form 1099-DA Broker Reporting Rules, and Managing IRS Examinations, on Tuesday, January 13, 2026, 9:00 a.m. – 10:30 a.m. (PST).

The program will provide a practical roadmap for examinations involving digital assets and will set forth an overview of the IRS’s guidance on digital asset transactions. This webinar will also examine how digital-asset compliance is changing, as Form 1099-DA broker reporting begins for transactions on or after January 1, 2025, and explain what taxpayers and their advisers should expect when payee statements start arriving in the 2026 filing season. The program will also address current developments under the new administration, alongside the IRS broader enforcement environment.

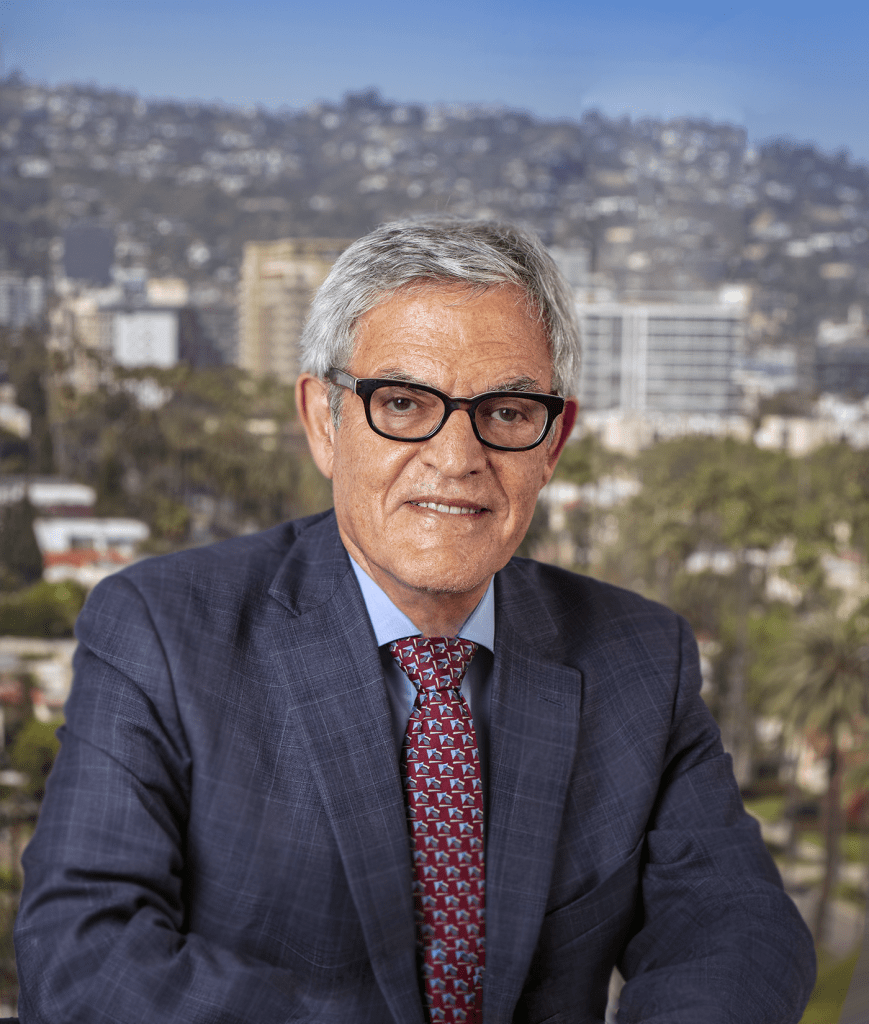

Michel R. Stein, a principal of Hochman Salkin Toscher Perez P.C., is a nationally recognized tax attorney with nearly 30 years of experience in tax controversy and planning for individuals and business entities. He is widely respected for his ability to resolve complex and sensitive tax controversies before the Internal Revenue Service and the California Franchise Tax Board, including matters involving significant civil and criminal exposure, and is a trusted resource to clients and advisors navigating the most challenging areas of federal and state tax law. His commentary and insights have been featured in leading tax publications, webinars, and media outlets addressing emerging issues in tax enforcement and policy.

Mr. Stein has represented hundreds of clients in civil tax examinations, administrative appeals, and litigation before the U.S. Tax Court, U.S. District Courts, California Superior Court, and the U.S. Courts of Appeals. He routinely advises and defends clients in matters involving California Residency, Digital Assets and Cryptocurrency Investigations, High-Net-Worth Taxpayer Compliance and Examination, Domestic and International Tax Compliance, Voluntary Disclosures and Streamlined Filings, Challenges to Listed and Reportable Transactions, Partnership Tax and Audit Rules, Employment Tax and Worker Classification Issues, as well as tax controversies arising from Complex Real Estate and Business Transactions. He began his legal career as an Attorney Advisor to Special Trial Judge Larry Nameroff of the U.S. Tax Court and is a Certified Specialist in Taxation Law by the State Bar of California.

For more information, please contact Michel R. Stein at stein@taxlitigator.com.

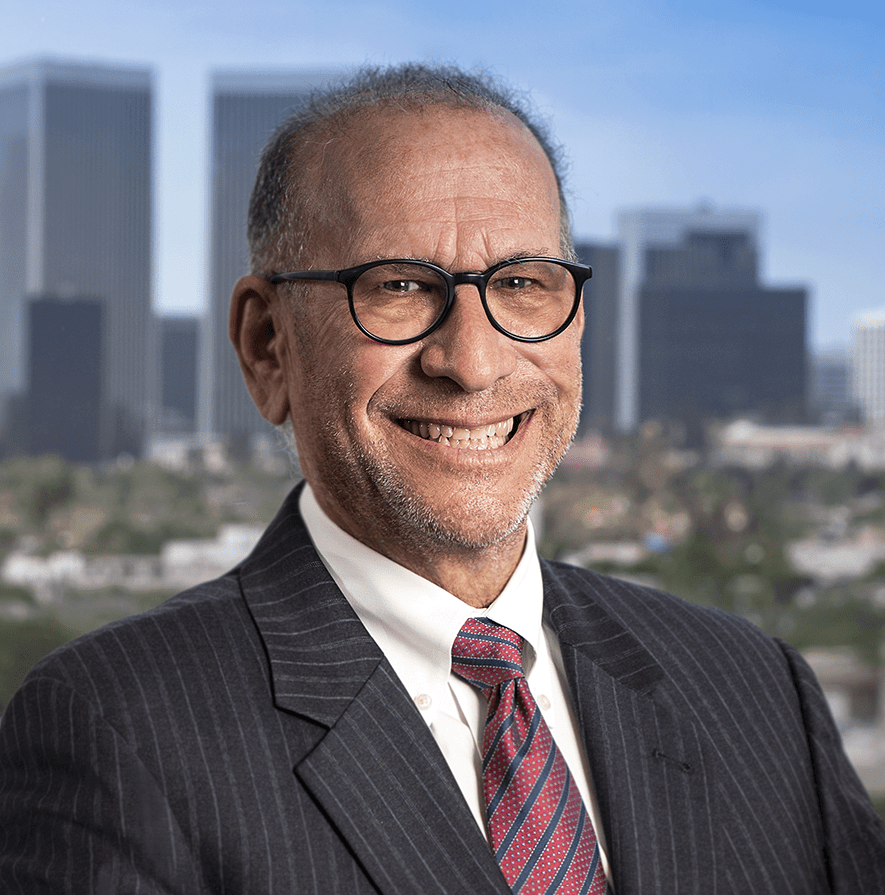

Philipp Behrendt is an Associate at Hochman Salkin Toscher Perez P.C., licensed in California as well as in Germany and assists in advising clients in civil and criminal tax controversies as well as international money laundering investigations stemming from tax avoidance structures. He also focuses on the technical aspects involved in advising voluntary disclosures in connection with DeFis, NFTs, and other crypto assets. Philipp is a Liaison to the Young Lawyer Committee for the ABA Tax Section’s Civil and Criminal Tax Penalties Committee and served on the Beverly Hills Bar Association’s Barristers Board of Governors from 2022 to 2023. Philipp is the Chair of the Beverly Hills Bar Association’s Tax Section and the Blockchain and Web3 Law Section.

For more information, please contact Philipp Behrendt at behrendt@taxlitigator.com.