The Employee Retention Credit (ERC) is a refundable tax credit created by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in 2020 to help businesses negatively impacted by the COVID-19 pandemic maintain their payroll. The credit has very specific eligibility requirements including full or partial suspension of business operations because of government orders and significant declines in gross receipts during 2020 or the first three quarters of 2021. Despite, or perhaps because of, these complex eligibility requirements, the IRS received a deluge of dubious claims caused by aggressive third-party promoters encouraging (oftentimes ineligible) employers to claim the ERC – receiving a percentage of the (oftentimes illegitimate) refund as payment for their “service.” For employers who have determined their claim is incorrect but have already received the ERC, the IRS created the Employee Retention Credit Voluntary Disclosure Program (ERC-VDP). The program allows employers to repay 80% of the credit to avoid paying interest or penalties, with an approaching deadline of March 22, 2024.

Tracking the ERC: Voluntary Disclosure Program Deadline Approaching and Other ERC Updates By SANDRA R. BROWN and HUNTER KEASTER

Posted in Uncategorized

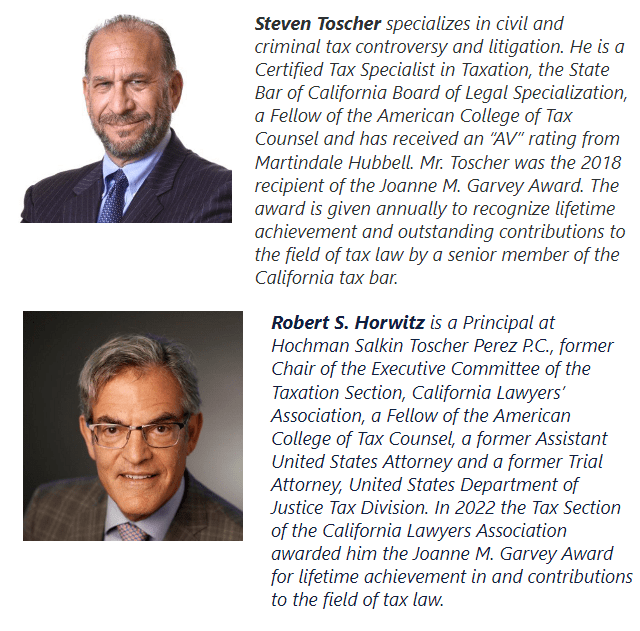

The IRS Bolsters Its Crypto Expertise and Other Tax Enforcement Agencies May Not Be Far Behind By STEVEN TOSCHER, ROBERT HORWITZ and PHILIPP BEHRENDT

The IRS has taken an important step to strengthen its understanding and oversight of the cryptocurrency space and may signal a bull market of tax enforcement in the crypto realm.

The agency recently announced the hiring of two private sector experts as advisors – Sulolit “Raj” Mukherjee and Seth Wilks. Both individuals have extensive experience working with digital assets and blockchain technology.

Raj Mukherjee most recently served as the Global Head of Tax for ConsenSys, a major blockchain software company. ConsenSys is known for its wallet software MetaMask. He has also held tax leadership roles at prominent exchanges like Coinbase, Binance.US, as well as at the Blockchain Association. His background includes over a decade of experience in tax compliance and reporting for both traditional finance and cryptocurrency businesses.

Seth Wilks was previously the Vice President of Government Relations and Success at TaxBit, a leading crypto tax software provider. Before that, he held a similar position at ProfitStance, another firm focused on crypto tax and accounting services. Wilks has worked extensively on digital asset tax policy issues over the past six years.

The IRS clearly sees a need to bolster its internal expertise on cryptocurrency and other digital assets. Commissioner Danny Werfel noted that it’s an evolving sector with major tax administration implications. By bringing in advisors like Mukherjee and Wilks, the IRS aims to successfully develop systems and programs focused on this emerging area.

Expanded work on digital assets is listed as one of the IRS’ key priority areas. This includes efforts to enhance the data on digital asset transactions, like the John Doe summons to seeking information on taxpayer’s transactions on platforms such as against Coinbase, Kraken, Poloniex, and others, or the proposed broker reporting regulations. The hiring of these two advisors should help the IRS stay on top of industry changes and help taxpayers comply with their crypto tax obligations.

This announcement is not the only event showing that the IRS is intent on making digital assets top priority. The IRS is currently working on new guidance that is expected to come trickling in throughout the year.

Additionally, in early February the Department of Justice announced the indictment of an individual for tax charges related to unreported cryptocurrency sales. So far, we have seen crypto-related tax charges being piled on money laundering or fraud charges, but not as standalone indictment. This signals increased enforcement in this domain and emphasizes the importance of compliance for those dealing with digital assets. Overall, the IRS is clearly gearing up its capabilities to oversee the taxation of cryptocurrencies.

The Financial Crimes Enforcement Network, better known as FinCEN.has also become interested in the crypto sphere. In a 2020 FinCEN Notice (Notice 2020-2), the agency expressed their intent to propose amendments to the FBAR regulations that would classify virtual currency accounts and addresses as financial accounts that must be reported under 31 CFR 1010.350. In other words, while cryptocurrency assets themselves are not reportable at present, FinCEN has announced plans to issue regulations requiring such holdings to be disclosed on FBARs We are still waiting for FinCen to issue these proposed regulations.

Now that the IRS has stepped up federal tax guidance, enforcement and reporting requirements for digital assets, more states may feel pressure to address this evolving area in order to align with federal rules. Only five states (Illinois, Michigan, New York, New Jersey, and Wisconsin) provide some guidance regarding the treatment of digital assets for income tax purposes. Several states have provided some guidance for sales tax purposes, among them California (see Reference #F22-12-084FU, California Department of Tax and Fee Administration, January 19, 2023). However, many uncertainties exist around state tax obligations and filings related to digital currencies.

Over the next year, we could see more state revenue agencies and legislatures exploring how to apply existing sales/use and income tax frameworks to cryptocurrency transactions. Clarified guidance would help both tax authorities and taxpayers understand the relevant compliance duties.

It’s clear the IRS is ramping up both their guidance and enforcement when it comes to cryptocurrency taxation. Other agency may profit from these efforts. With its latest move of bringing in seasoned experts from the industry, the IRS is signaling an intent to more closely monitor this emerging sector. Between expanded reporting obligations, greater reporting from centralized exchanges, and beefed-up enforcement capabilities, the IRS has made it a top priority to single out those not adhering to crypto tax rules. Additional audit resources allocated under the Inflation Reduction Act will allow the IRS to more vigorously pursue taxpayers failing to properly report cryptocurrency transactions and holdings. As the agency works to close the tax gap, those holding cryptocurrencies and engaging in cryptocurrency transactions should expect even more scrutiny in the coming years.

Posted in Uncategorized

Thawing the Ice: Landmark Indictment Signals New Era in Crypto Tax Enforcement by SANDRA R. BROWN and PHILIPP BEHRENDT

What It’s About

On February 7, the Justice Department announced a seven-count indictment against Frank Richard Ahlgren III, charging him with filing false tax returns and structuring transactions based on his cryptocurrency dealings between 2017 and 2019. Ahlgren faces three counts of filing false tax returns under 26 U.S.C. section 7206(1), related to underreporting or not reporting the sale of $4 million worth of bitcoin. In 2017, he allegedly inflated the basis of bitcoin sold and failed to report several bitcoin sales in subsequent years. Additionally, he is charged with four structuring charges for attempting to evade currency reporting requirements during cash deposits of sale proceeds.

Significance of the Case

This indictment represents a departure from previous cases primarily focused on money laundering or fraud, instead centering squarely on tax charges stemming from cryptocurrency transactions. This shift marks a significant move towards criminal enforcement for tax non-compliance in the crypto space.

What sets this case apart is its temporal context. Many tax professionals anticipated that the first instance of solely tax-related charges would occur for tax periods starting with tax year 2020 or later, given the prominent placement of the crypto question on the first page of the tax returns during those periods, making it more conspicuous. However, these charges span the years 2017 through 2019. Notably, while the 2019 tax return included a crypto-related question, albeit not on the front page, the 2017 and 2018 returns lacked any crypto-related question.

As an aside, what may have contributed to DOJ’s reach back to 2017 is the very public civil litigation between the defendant and the trustees of the Ahlgren Management Trust, Case no. D-1-GN-20-001472 261st Judicial District, Travis County, Texas, which was filed in 2020. A June 15, 2023 Memorandum Opinion by the Texas Court of Appeals spent a fair amount of time discussing the 2017 Bitcoin traceable transactions.

Lessons for Taxpayers

The Ahlgren case serves as a sobering reminder for taxpayers involved in cryptocurrency transactions. Despite ongoing debates surrounding reporting thresholds and requirements, the obligation to report capital gains and ordinary income remains non-negotiable.

While the outcome of the case in court remains uncertain, it signifies the commencement of a heightened level of tax enforcement within this domain. The Department of Justice is sending a clear message – tax charges are a real possibility for failure to report cryptocurrency transactions, thus elevating the stakes of tax compliance in the cryptocurrency realm.

The DOJ press release highlighted that the IRS is investigating the case, underscoring the collective commitment to lift its structural enforcement deficits in the crypto space. Tax compliance is key to staying out of trouble, both civilly and criminally.

Historically, taxpayers holding crypto were often left with very little guidance when it came to filing their taxes, leading to non-compliance with rules that are now becoming more clear. By taking proactive steps with knowledgeable counsel, you can rectify past discrepancies and avoid potential legal ramifications. Investing in experienced tax counsel today can safeguard your financial future tomorrow, ensuring compliance and peace of mind as you navigate the complex landscape of tax regulations.

Sandra R. Brown is a Principal at Hochman Salkin Toscher Perez P.C., and former Acting United States Attorney, First Assistant United States Attorney, and the Chief of the Tax Division of the Office of the U.S. Attorney (C.D. Cal). Ms. Brown specializes in representing individuals and organizations who are involved in criminal tax investigations, including related grand jury matters, court litigation and appeals, as well as representing and advising taxpayers involved in complex and sophisticated civil tax controversies, including representing and advising taxpayers in sensitive-issue audits and administrative appeals, as well as civil litigation in federal, state and tax court.

Philipp Behrendt is an Associate at Hochman Salkin Toscher Perez P.C., licensed in California as well as in Germany and assists in advising clients in civil and criminal tax controversies as well as international money laundering investigations stemming from tax avoidance structures. He also focuses on the technical aspects involved in advising voluntary disclosures in connection with DeFis, NFTs, and other crypto assets.

Posted in Uncategorized

SANDRA BROWN to Speak at Upcoming ABA White Collar Crime Institute (Updated Speakers)

We are also pleased to announce that Sandra R. Brown will be moderating a panel at the upcoming ABA 39th National Institute on White Collar Crime on the topic of “The Powers and Perils of Parallel Criminal and Civil Investigations” on Wednesday, March 6, 2024, 10:30 a.m. (PST), with panelists Ronald Cheng (Pillsbury Winthorp), Caroline Ciraolo (Kostelanetz), Mary Hammond (IRS Global Operations Policy & Support) and Pamela L. Johnston (Foley & Lardner).

Posted in Uncategorized

MICHAEL GREENWADE to Speak at Upcoming Beverly Hills Bar Association Webinar

We are pleased to announce that Michael Greenwade along with Andrea N. Erdahl (SBSE Examination) will be speaking at the upcoming Beverly Hills Bar Association webinar “The Fundamentals of Information Reporting” Tuesday, March 5, 2024, 12:30 p.m. – 1:30 p.m. (PST).

This program will go over the fundamentals of compliance related to international information return filings in order to provide taxpayers and professionals with up-to-date information, including potential consequences for non-compliance, resources available, and practical knowledge to resolve issues that may arise. As the landscape of global reporting requirements is ever-evolving, this program will assist with that to expect and how to prepare for the compliance standards of today.

Posted in Uncategorized

SANDRA BROWN to Speak at Upcoming ABA White Collar Crime Institute and FBA 2024 Tax Law Conference

We are pleased to announce that Sandra R. Brown will be speaking at the upcoming Federal Bar Association 2024 Tax Law Conference on the topic of “May You Live in Interesting Times – The Latest in Criminal Investigations and Sentencings” on Tuesday, March 5, 2024, 11:00 a.m. – 12:00 p.m. (PST), along with co-panelists Caroline Ciraolo (Kostelanetz), Eric Hylton (alliantgroup), and Jeffrey Neiman (Marcus, Neiman Rashbaum & Pineiro).

Click Here for More Information

We are also pleased to announce that Sandra R. Brown will be moderating a panel at the upcoming ABA 39th National Institute on White Collar Crime on the topic of “The Powers and Perils of Parallel Criminal and Civil Investigations” on Wednesday, March 6, 2024, 10:30 a.m. (PST), with panelists Ronald Cheng (Pillsbury Winthorp), Caroline Ciraolo (Kostelanetz), Mary Hammond (IRS Global Operations Policy & Support) and Byron McLain (Foley & Lardner).

Posted in Uncategorized

Taxpayer Advocate Highlights 10 Most Critical Problems Facing IRS by ROBERT HORWITZ and MICHAEL GREENWADE

The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service (IRS), which prides itself on being the “Voice of the Taxpayer” with the IRS and before Congress. By statute, the National Taxpayer Advocate (NTA), a position held by Erin Collins, who heads TAS, is required to submit an Annual Report to Congress that contains, among other things, an analysis of 10 of the most critical problems encountered by taxpayers in their dealings with the IRS.

Posted in Uncategorized

ROBERT HORWITZ and JONATHAN KALINSKI to Speak at Upcoming Strafford Webinar

We are pleased to announce that Robert Horwitz and Jonathan Kalinski will be speaking at the upcoming Strafford webinar “IRS’ Current Audit Campaign: Preparing for Large Partnership, Complex PTE, and HNW Taxpayer” Tuesday, February 27, 2024, 10:00 a.m. – 11:50 a.m. (PST).

In Notice 2023-166, the IRS announced its shift in focus from working-class taxpayers to wealthy taxpayers. With funds supplied by the Inflation Reduction Act, the IRS is concentrating its attention on large corporations and partnerships, high-income earners, and abusive tax avoidance promoters.

Within the notice, the IRS explained that a “major expansion in high-income/high wealth and partnership compliance work” is a key element of the new campaign. Specifically included are taxpayers with income above $1 million and more than $250,000 in tax debt, and partnerships with over $10 million in assets with ongoing balance sheet discrepancies. Perhaps the greatest cause of unrest is the IRS’ statement that its compliance team will use AI to aid in these examinations.

The IRS established a new division within its Large Business and International Division to assist with these audits. This new IRS unit will take a broader look at all complex partnerships. With the heightened reporting requirements for these flow-through entities, PTE practitioners and owners need to be wary but ready for the IRS’ latest campaign.

Listen as our panel of notable federal tax litigation experts analyzes the IRS’ current enforcement efforts and steps partnerships and high net worth individuals must take to prepare.

We are also pleased to announce that we will be able to offer a limited number of complimentary and reduced cost tickets for this program on a first come first serve basis. If you are interested in attending please contact Sharon Tanaka at sht@taxlitigator.com.

Posted in Uncategorized

EVAN DAVIS to Speak at Upcoming USD School of Law – Chamberlain International Tax Institute

We are pleased to announce that Evan Davis will be speaking at the upcoming USD School of Law – Chamberlain International Tax Institute Conference on the on the topic of “Attorney-Client Privilege and Confidentiality Limitations in International Tax Matters” on Monday, February 19, 2024, 3:00 p.m. – 4:00 p.m. (CST), along with co-panelists Ana Elena Domínguez, Galicia Abogados (Mexico City), Jeremy Temkin, Morvillo, Abramowitz, Grand Iason & Anello PC (New York City), and Jaime Vásquez, Chamberlain Hrdlicka (San Antonio)

This panel will focus on the limits of attorney-client privilege and confidentiality in the context of cross-border representation and tax advice. Criminal and civil tax law experts and former prosecutors will explain some of the practical limitations and what steps would often be advisable regarding advice provided to cross border taxpayers in delicate transactions.

Posted in Uncategorized

DENNIS PEREZ, MICHEL STEIN and JONATHAN KALINSKI to Speak at Upcoming CalCPA Webinar

We are pleased to announce that Dennis Perez, Michel R. Stein, and Jonathan Kalinski will be speaking at the upcoming CalCPA webinar “Resolving Federal and State Employment Tax Matters – Worker Classification” Tuesday, February 20, 2024, 9:00 a.m. – 10:00 a.m. (PST).

The IRS is increasing both civil and criminal enforcement against taxpayers who fail to comply with withholding and remitting of employment taxes. Noncompliance can cause heavy penalties and interest against taxpayers that could destabilize a company and its operations and expose responsible company officers to personal liability. Tax professionals and advisers must grasp a complete understanding of tax rules and available techniques to avoid or minimize tax assessments and penalties. This webinar will guide tax professionals and advisers on critical issues relating to employment taxes. The panel will discuss essential techniques to avoid penalties and handling IRS audits stemming from employment taxes. The panel will also address worker classification issues and methods to overcome them, the impact of California AB 5, key considerations for state versus federal compliance, the Government use of injunctions and criminal aspects.

Posted in Uncategorized