We are pleased to announce that the USC Gould School of Law 2025 Tax Institute will take place on January 27-29 at the Sheraton Grand Hotel, Los Angeles.

We have an exceptional line up of speakers and topics this year. The three day Institute covers the most important topics in taxation including corporate, partnership, and estate planning. Additionally, the Tuesday afternoon sessions will cover current topics focused on civil and criminal tax controversy and ethical issues which are important to all tax practitioners.

The Institute is by far one of the best programs in the country for both experienced tax practitioners and those looking to gain more experience in their tax practices.

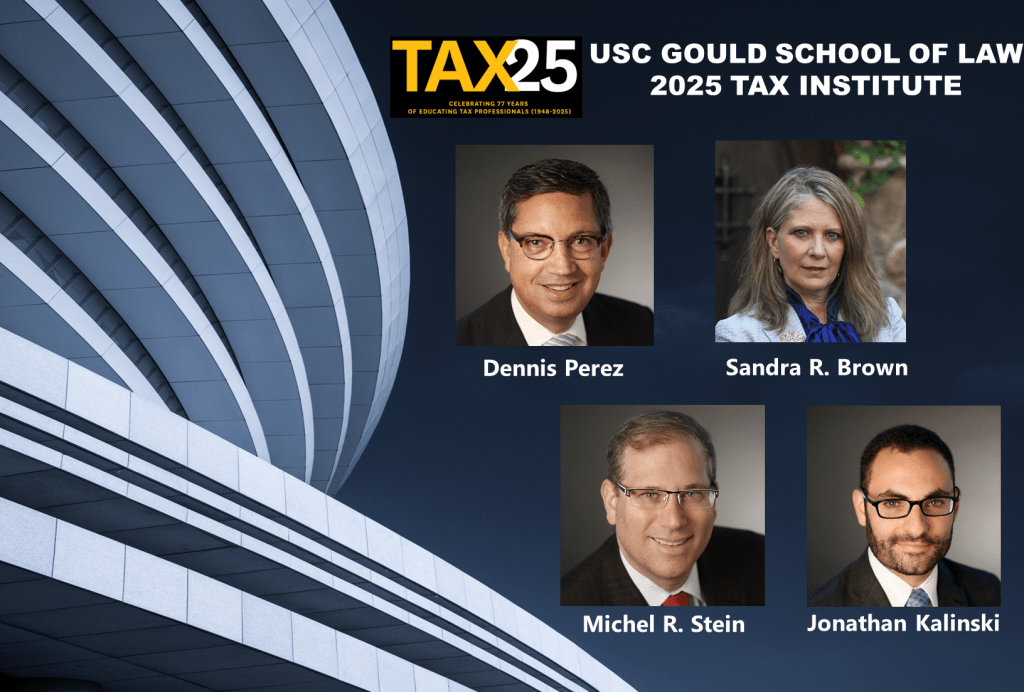

We are pleased to announce that four of our Principals will be presenting this year.

Dennis Perez

A New Era of the IRS Assertion and Defense of the Civil Fraud Penalty

January 28, 2025: 4:25-5:25 pm

Sandra R. Brown

Employee Retention Credits: How a Good Idea to Address COVID Became Extraordinary Challenge to the IRS, Practitioners and Business

January 28, 2025: 3:10-4:10 pm

Michel R. Stein

The IRS New Focus on Subchapter K Enforcement, including the Use of the Economic Substance Doctrine – What Does it Mean for Tax Practitioners

January 28, 2025: 2:00-3:00 pm

Jonathan Kalinski

Defending Tax Controversies Du Jour

January 28, 2025: 5:45-6:45 pm

Registration information and the full program can be found here.

We look forward to seeing you.

Dennis Perez is a Principal of the law firm Hochman Salkin Toscher Perez P.C. and has extensive experience in the representation of clients in civil and criminal tax litigation and in tax disputes and controversies before the Internal Revenue Service and all the California taxing agencies. Mr. Perez was formerly a senior trial attorney with District Counsel, Internal Revenue Service, in Los Angeles, California. Mr. Perez is a Certified Tax Specialist, California State Bar Board of Certification and is also a Fellow of the American College of Tax Counsel. He frequently lectures on advanced civil and criminal tax topics at seminars and before national, state and local bar associations and accountancy groups.

He is a co-author of the BNA Portfolio, Tax Crimes, has served as the Chair of the Los Angeles Lawyer Magazine Editorial Board and is the first recipient of the Los Angeles Lawyer Sam Lipsman Service Award for outstanding service to the Los Angeles Lawyer Magazine. He is past Chair of the Tax Procedure and Litigation Committees of the Taxation Sections of the State Bar of California and the Los Angeles County Bar Association. Mr. Perez is past President of the Alumni Board for the UCLA School of Law and has served as an Adjunct Professor, Golden Gate University, Graduate School of Taxation.

For more information, please contact Dennis Perez at perez@taxlitigator.com

Sandra R. Brown is a Principal of the law firm Hochman Salkin Toscher Perez P.C., where she specializes in criminal tax investigations, grand jury matters, litigation and appeals, as well as representing and advising taxpayers involved in complex and sophisticated civil tax controversies, including sensitive-issue audits and administrative appeals, as well as civil litigation. Prior to joining the firm, Ms. Brown served as the Acting United States Attorney, First Assistant United States Attorney; and Chief of the Tax Division in the Office of the U.S. Attorney, Central District of California.

During her 27 years as a trial lawyer, she personally handled over 2,000 tax cases on behalf of the United States. During her tenure with the government, Ms. Brown received the Internal Revenue Service Criminal Investigation Chief’s Award and the IRS’s Mitchell Rogovin National Outstanding Support of the Office of Chief Counsel Award, the highest recognitions awarded by the IRS to non-IRS employees.

Ms. Brown obtained her LL.M. in Taxation from the University of Denver, is a fellow of the American College of Tax Counsel, Vice-Chair of the ABA’s Section of Taxation’s Criminal and Civil Tax Penalties Committee, Co-Chair of the UCLA Tax Controversy Institute, Co-Chair of the ABA Criminal Tax Fraud and Tax Controversy Conference, an ABA Loretta Collins Argrett Fellowship Mentor, and is a frequent lecturer and author on tax controversy topics, including international compliance matters. Ms. Brown has been recognized as one of California’s top 100 leading women lawyers and most recently, the recipient of USD School of Law’s Richard Carpenter Excellence in Tax Award and honored at the California Lawyers Association Tax Bar and Tax Policy 2024 Toast to Women in Tax.

For more information, please contact Sandra Brown at brown@taxlitigator.com

Michel R. Stein is a Principal at Hochman Salkin Toscher Perez P.C., specializing in tax controversies, as well as tax planning for individuals, businesses and corporations. For more than 25 years, he has represented individuals with sensitive issue civil and criminal tax matters where substantial penalty issues may arise, and extensively advised individuals on foreign and domestic voluntary disclosures regarding foreign account and asset compliance tax matters. Mr. Stein is a frequent lecturer at national and regional conferences on topics, including Global High Wealth examinations, cryptocurrency, sensitive tax compliance matters, IRS examinations, International tax issues and state and federal residency and worker classification matters.

For more information, please contact Michel R. Stein at stein@taxlitigator.com.

Jonathan Kalinski is a Principal of the law firm of Hochman Salkin Toscher Perez P.C. and specializes in both civil and criminal tax controversies as well as sensitive tax matters including disclosures of previously undeclared interests in foreign financial accounts and assets and provides tax advice to taxpayers and their advisors throughout the world. He handles both Federal and state tax matters involving individuals, corporations, partnerships, limited liability companies, and trusts and estates. Mr. Kalinski is a California Lawyers Association Taxation Section Executive Committee Member and an ABA Loretta Collins Argrett Fellowship Mentor.

For more information, please contact Jonathan Kalinski at kalinski@taxlitigator.com

Leave a comment