On July 1, the Supreme Court issued its opinion in Corner Post, Inc. v. Federal Reserve Board, 603 U.S. ____ (2024), its second major decision in four days that expanded the ability of aggrieved parties to challenge federal agency regulations, including tax regulations. Under 28 U.S.C. §2401(a), a person has six years within which to file a civil suit against the United States Government. The issue in Corner Post, Inc., was whether a person who claims injury due to final agency action has six years from the date of injury or six years from the date of final agency action within which to file a lawsuit.

Posted by: sbbrown64 | July 11, 2024

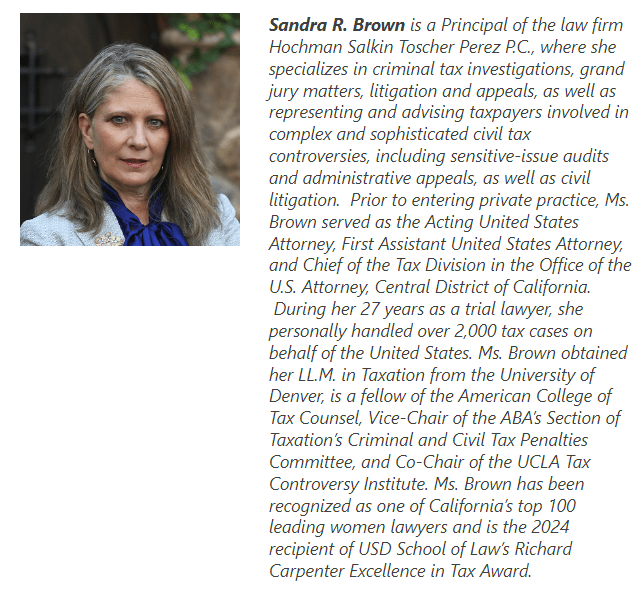

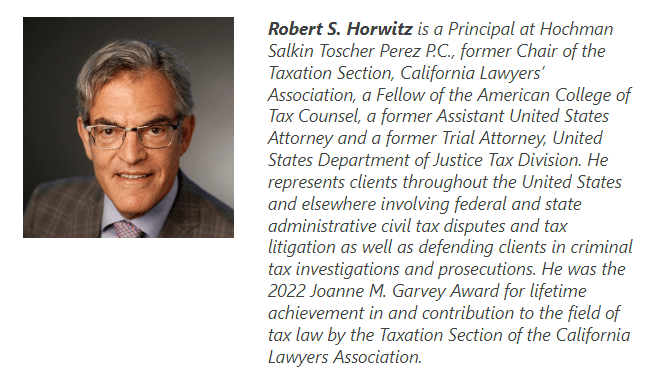

The Supreme Court Expands the Ability to Challenge Tax Regulations by: SANDRA R. BROWN AND ROBERT S. HORWITZ

Posted in Uncategorized

Leave a comment