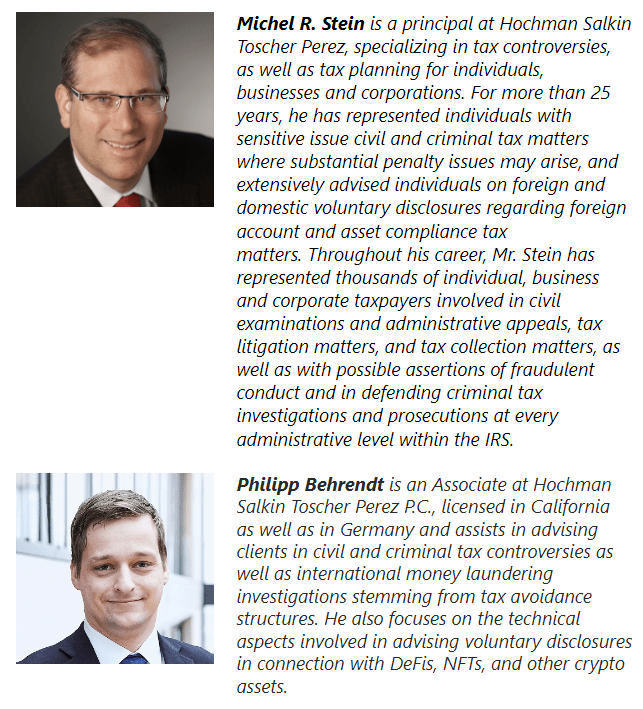

We are pleased to announce that Michel R. Stein and Philipp Behrendt will be speaking at the upcoming CSTC San Francisco Chapter webinar on “Cryptocurrency Tax Compliance: Tax Filing Requirements, Managing IRS Examinations & Tax Treatment of Digital Currency,” on Wednesday, June 5, 2024 from 6:00 p.m. – 8:00 p.m. (PST).

Cryptocurrency has exploded over the last few years causing significant concerns regarding the taxation of these transactions for sellers, purchasers, and investors. Tax counsel and accountants representing clients holding and selling cryptocurrency, including those engaging in mining, exchanges, staking and lending, must understand applicable tax rules and reporting requirements for these transactions. During the webinar we will discuss: The various types of cryptocurrency and exchanges, valuation issues, tax reporting requirements for cryptocurrency exchanges, disclosure requirements for cryptocurrency ownership, tax treatment of hard forks, staking and lending transactions and the likelihood of criminal investigations and prosecutions for failing to properly report cryptocurrency transactions, and the use of the IRS Voluntary Disclosure policy to get into compliance including “qualified amended returns” to avoid penalties.

Leave a comment